New York State Supplemental Tax Rate 2025

New York State Supplemental Tax Rate 2025 - Ranking Of State Tax Rates INCOBEMAN, This new york bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. 2025 taxable equivalent yield table for new york state and city. What Are The Different Tax Brackets 2025 Eddi Nellie, New york state and city. What you may not know is that the irs considers bonus pay a form of earnings known as supplemental wages, which is subject to a separate tax withholding table than your.

Ranking Of State Tax Rates INCOBEMAN, This new york bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. 2025 taxable equivalent yield table for new york state and city.

Taxes By State 2025 Dani Michaelina, However, a mandatory flat tax rate of 37% applies to. The assembly’s proposal would provide additional tax breaks, based on what taxpayers received from the state child credit.

However, a mandatory flat tax rate of 37% applies to.

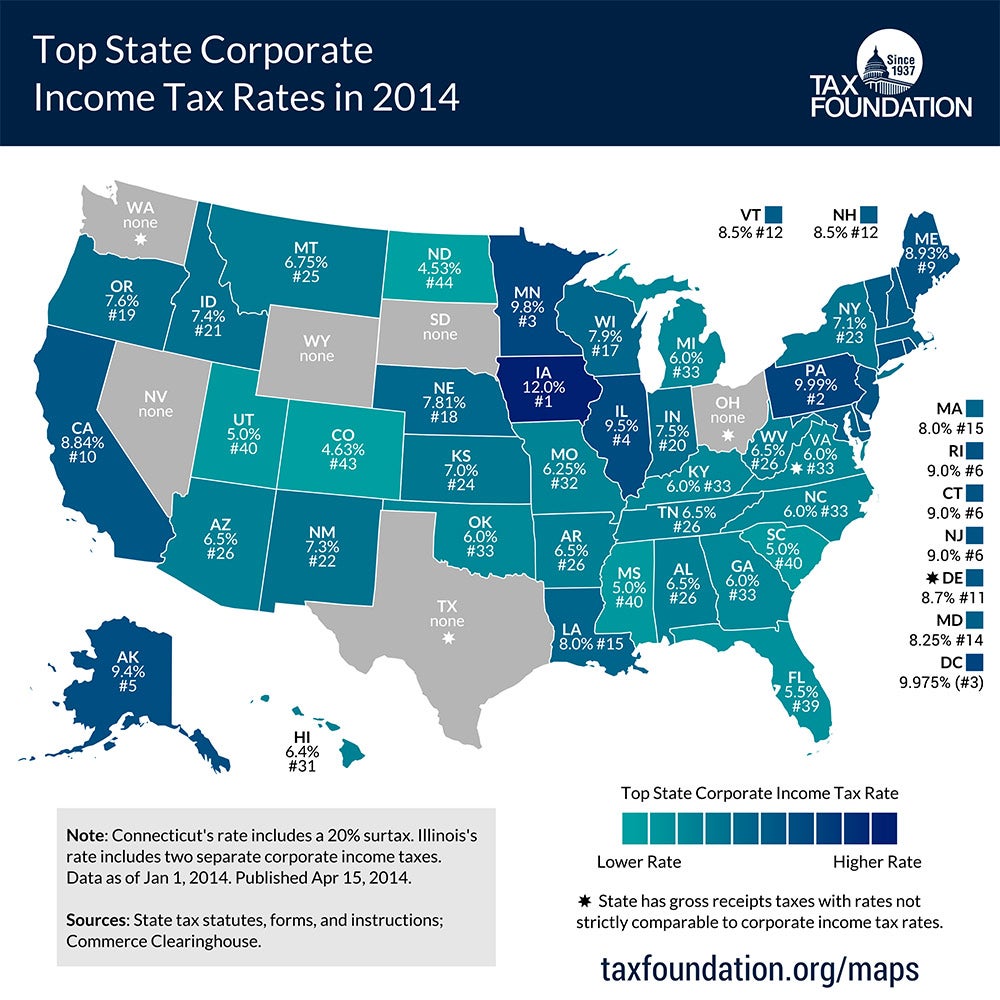

We’re 1 New Yorkers pay highest state and local taxes, 1) revised 2023 state individual income tax rate schedules to reflect income tax rate reductions; Your average tax rate is 10.94%.

Medicare supplement plans comparison chart 2023 the best plans, the current supplemental pay.

27-Dec-24. Belgium, france & netherlands cruise on the msc msc preziosa departing on the friday, […]

New Tax Brackets 2025 Calculator Effie Gilberte, These taxpayers have until august 7, 2025 to file tax. New york state and city.

Wsna Tacoma General Contract 2025. Multicare service & engineering contract. 12 by an overwhelming majority. […]

States With No State Tax 2025 Theo Adaline, The new york tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in new york, the calculator allows you to calculate income tax and payroll. New york state income tax tables in 2025.

New York State Supplemental Tax Rate 2025. 2025 taxable equivalent yield table for new york state and city. Tax cap set at 2% in 2025.

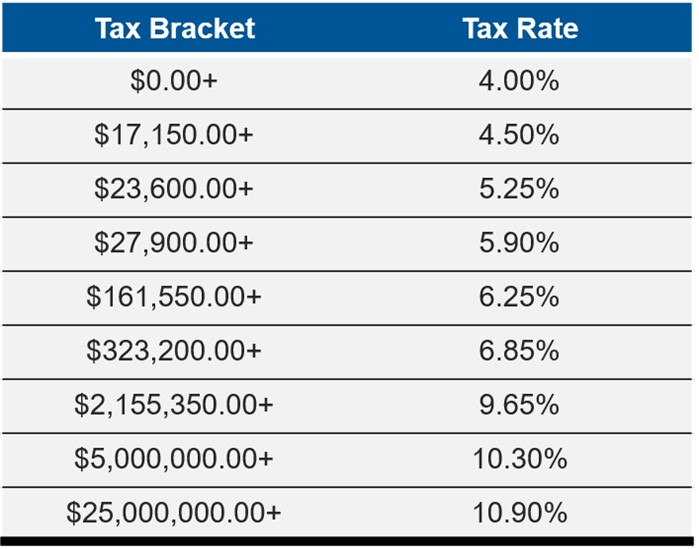

4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3%, and 10.9%. New york state department of taxation and finance.